Health plan options

In rare circumstances – if you spend more than 120 days out of the country, for example – you may need to choose our Indemnity plan.

Key benefits: Lower monthly premiums, lower out-of-pocket costs.

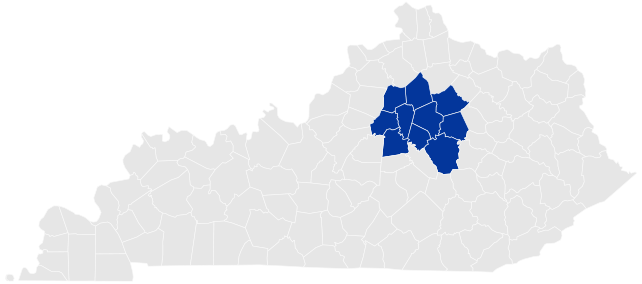

Considerations: Available if you live in the 10-county Central Kentucky area. UK HealthCare is your provider network and UK Health Care Retail Pharmacies will be your network for many maintenance medications. UK Retail Pharmacies offer convenient locations, mail order service, on-campus delivery, and even have the only 24-hour pharmacy in Lexington.

UK’s HMO plan is a great option for those who live in Central Kentucky and enjoy the convenience of seeing UK HealthCare providers.

The HMO plan also offers the lowest out-of-pocket costs of all our health insurance plans including:

On the HMO plan, you’ll use UK Retail Pharmacies for your prescriptions. If you have an urgent need for a one-time prescription, you can use any pharmacy that accepts ExpressScripts. But for ongoing prescriptions, you’ll use UK Retail Pharmacies.

UK Retail Pharmacies offer convenient locations, mail order service and on-campus delivery.

Learn more about UK Retail Pharmacies

| Annual deductible | $100 employee-only, $200 family coverage |

|---|---|

| Medical out-of-pocket maximum | $3,000 employee-only, $6,000 family coverage |

| Prescription out-of-pocket maximum | $5,000 employee-only, $10,000 family coverage |

Currently, King's Daughters Medical Center in Ashland and St. Claire Regional Medical Center in Morehead are not part of the UK HealthCare network.

In rare circumstances – if you spend more than 120 days out of the country, for example – you may need to choose our Indemnity plan.

| Coverage level | Total monthly cost* | UK pays | You pay |

|---|---|---|---|

| Employee only | $799 | $744 | $55 |

| Employee + children | $1,238 | $1,067 | $171 |

| Employee + spouse | $1,837 | $1,466 | $371 |

| Employee + family | $2,277 | $1,747 | $530 |

* Regular part-time and temporary employees (less than 0.75 FTE or work less than an average of 30 hours per week in a 12-month measurement period), who are not eligible for the UK credit toward the costs of coverage, pay this rate.

If you and your spouse both work at UK and are eligible for UK's credit toward health insurance, and you have dependents to cover on your health insurance plan, you may enroll in Combined Credit coverage at the employee + family level. The monthly rate on the HMO plan is $226.

Please reach out to our HR Benefits team if you have questions about Combined Credit coverage.

| HMO plan | Service | Cost with UK HealthCare |

|---|---|---|

| Preventive care (Coverage under preventive care category depends on age, symptoms and diagnosis | Routine Pap smears, mammograms, PSA, screening colonoscopy, and sigmoidoscopy | $0 |

| Routine childcare and immunizations (through age 18) | $0 | |

| Routine adult physical exam (19 years and above, one per plan year) | $0 | |

| Physician services | Primary care office visits (excludes certain diagnostic lab and X-ray) | $10 co-pay |

| Specialist office visits (excludes certain diagnostic lab and X-ray) | $35 co-pay | |

| Advanced imaging | $75 co-pay | |

| Routine diagnostic labs | 10% co-insurance | |

| Diagnostic radiology/labs | 10% co-insurance | |

| Allergy injections | $10 co-pay | |

| Hospital services | Inpatient care | $250 co-pay |

| Outpatient surgery | $75 co-pay | |

| Emergency/urgent services | Emergency room visit | $100 co-pay then 20% co-insurance (waived if admitted to the hospital) |

| Urgent treatment center | $35 co-pay | |

| Ambulance | 20% co-insurance | |

| Other medical services | Skilled nursing facility | 10% co-insurance |

| Home health care | 20% co-insurance | |

| Durable medical equipment Note: Continuous glucose monitors are covered at 100% at UK Retail Pharmacies with no co-pay or co-insurance. |

20% co-insurance | |

| Hospice | 10% co-insurance | |

| Outpatient therapies (PT, OT, ST) | $15 co-pay | |

| Mental health and substance abuse | Inpatient mental health or substance abuse | $250 co-pay |

HMO plan members have access to the expertise of UK HealthCare providers. Currently, King's Daughters Medical Center in Ashland and St. Claire Regional Medical Center in Morehead are not part of the UK HealthCare network.

UK-HMO Plan Administrator

ukhmo@uky.edu

859-257-8251

Welcome to UK! You can sign up for benefits depending on your FTE. Enroll in your benefits quickly in myUK.

If you experience a major life change outside of open enrollment you can also make changes to your insurance. This is known as a qualifying event. You'll need to fill out and submit a form within 30 days.

Our Benefits Open Enrollment happens every year so you can make changes. Changes can be made in myUK, or with paper forms.

Please use the Retiree Benefits Enrollment form and return to Bosworth Hall.

Signing up as a new employee or making changes during Benefits Open Enrollment can be done in myUK, or with paper forms.

Making changes at other times of the year due to a qualifying event are completed using our Benefits Enrollment Form.

Paper forms can be emailed, faxed or brought to Bosworth Hall.